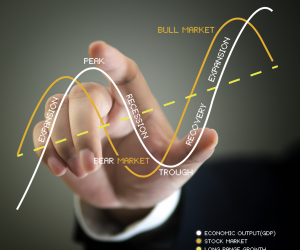

Investment Selection Styles: Portfolio Construction Implications Classic equity portfolio management of mutual funds, insurance product subaccounts and separately managed accounts predominately utilize either a growth or value style investment selection process, or a blend of the two investment styles. This discussion of equity investment selection styles relates only to the portion of a portfolio which…

Read more

Investment Selection Styles: Portfolio Construction Implications