Another year has come and gone. It’s hard for some individuals to not feel a sense of regret as time keeps marching by and there always seems to be so much to do, to keep up, to keep from falling behind, to accomplish the goals we want for ourselves and our families. I just had…

Read more

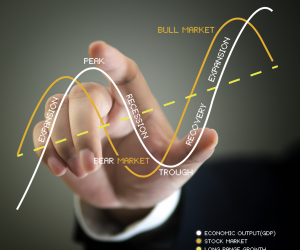

A Financial Plan Annual Review Can Help You Stay on Course