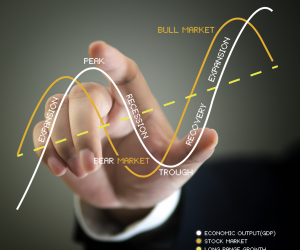

Academic research suggests that investors can realize greater investment returns over multiple business cycles when they allocate a portion of the investment portfolios in small and mid cap sized companies. Many investors place too great an emphasis on large cap stocks for their asset allocation models. By so doing, investors miss a significant portion of…

Read more

Multi-Cap Investment Strategies Provide Benefits to Investors In The Long Run