Many invest savings over a lifetime towards meeting their retirement goals. For some, these retirement goals are an abstract concept and for others they are well-defined. In any case, at the time of retirement, most individuals define retirement success as “not running out of money”. During times of market volatility, many retired investors experience a real fear of loss when the securities markets drop precipitously. The lost sense of financial security for most retired investors comes from what is known by investment professionals as Sequence of Returns Portfolio Risk which may ultimately result in a spend down of their retirement investment portfolio.

Later in this discussion we will illustrate the effects of Sequence of Returns Portfolio Risk with different investment outcomes for two investment portfolios during which time inflation-adjusted withdrawals are made. Along with increasing withdrawals, and the effects of market volatility, you can observe significantly different retirement outcomes. This is known as Sequence of Returns Portfolio Risk whose random outcomes create a significant issue to unwary financial advisors and their clients.

Later in this discussion we will illustrate the effects of Sequence of Returns Portfolio Risk with different investment outcomes for two investment portfolios during which time inflation-adjusted withdrawals are made. Along with increasing withdrawals, and the effects of market volatility, you can observe significantly different retirement outcomes. This is known as Sequence of Returns Portfolio Risk whose random outcomes create a significant issue to unwary financial advisors and their clients.

Asset Allocation – Strategic vs. Tactical Approach

There is much confusion amongst the investing public about the importance of asset allocation throughout an investor’s financial lifecycle. This is not a discussion about passive or active management and the associated costs, such as fees, commissions, and taxes. This is a discussion about “mitigation of risk” throughout an investor’s financial lifecycle designed to manage Sequence of Return Portfolio Risk which may result in the spend down of your financial “nest egg”.

Most conventional wisdom asserts that over the “long run” a portfolio’s asset allocation should reflect the investor’s risk tolerance with a focus on potential losses in value during market downturns. The understanding of many investors is that over longer periods of time, a strategic allocation based on risk tolerance, will result in the expected outcomes. As a matter of fact, many investors seem to not appreciate the importance of the differences between in asset allocation strategies.

Sequence of Returns Portfolio Risk Scenarios – Different Retirement Outcomes

The following scenarios are designed to illustrate the differences between two retirement portfolio outcomes based on a set of assumptions. First, the retirement portfolio income generated for retirement is set at a sustainable-rate and adjusted annually for inflation. Second, each retirement portfolio outcome is subject to a different “sequence of returns” over the period analyzed.

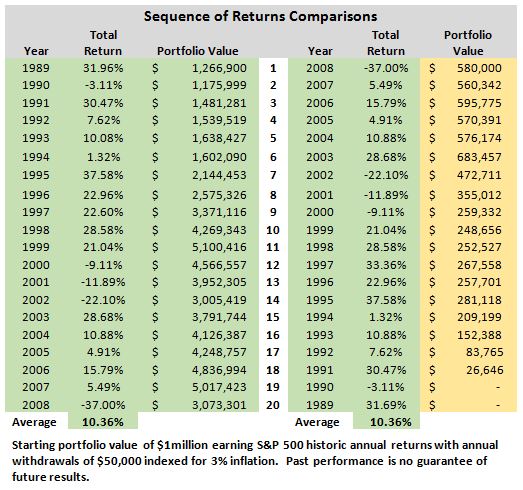

For illustrative purposes, the chart below titled “Sequence of Returns Comparison” demonstrates the effects of Sequence of Returns Portfolio Risks for similar retirement portfolios. It shows a $1 million retirement portfolio invested in the S&P 500 Index, from which $50,000 a year is being withdrawn for income (indexed 3% for inflation). The results are as follows: In the green columns, we see how that retirement portfolio would have been affected by the actual returns of the stock market (S&P 500 index) for the 20-year period of 1989-2008.

The yellow columns show how that same portfolio, invested in the S&P 500 Index, would have performed if the sequence of those returns had been reversed. The average annual portfolio return over the same time period is exactly the same in each section at 10.36%, but one portfolio has grown to over $3 million, and the other portfolio experienced a “spend down” to zero in 18 years. The only difference is the order in the Sequence of Returns and the associated risks to the retirement portfolios. This example analysis is for illustrative purposes only. Investment accounts with different asset allocations with result in different illustrative outcomes.

Sequence of Returns Risks – Managing the Risk

True North Financial Advisors recognizes the need to manage Sequence of Returns Portfolio Risk and the corresponding effect on the risk of a portfolio “spend down”. True North Financial Advisors employs various techniques to manage the risks of “spend down” during retirement.

| First, a statistical analysis known as a Monte Carlo Simulation Analysis is used you determine what is a safe, sustainable rate of withdrawal rate based on the assumed portfolio asset allocation determined by an investor’ investment objective, risk tolerance and client-specific life-cycle considerations. The Monte Carlo Simulation Analysis does not rely on long-term average returns to make projections but will take into account the many possible sequences of returns to help you see your likelihood of “success” at generating various levels of portfolio income. |

|

|

Second, True North Financial Advisors will help you develop various portfolios or “buckets” used to insulate your investments from market volatility and the need for retirement income. The first bucket is for your current income needs – three years’ worth. These funds will be invested more conservatively – in cash equivalents, short-term bonds and less volatile  securities. In the event the market declines, you will have the funds available for distribution with no worries about having enough income. You set the time periods for each portfolio based on sources of income not dependent of market conditions, in this instance you would have three years’ worth of income that’s not affected by market conditions. A second “bucket” with enough money for another four years or more of income. These portfolio funds would be invested in a mix of longer-term bonds and stocks for growth. That way the money has the potential to grow, but with less risk of significant losses during market downturns. A third “bucket” is for portfolio funds not expected for distribution for seven years or more. These funds can be invested more aggressively based on your risk tolerance and this investment time horizon. This approach to developing various portfolio “buckets” reduces the risk of spend down and provides for more productive use of portfolio funds.

securities. In the event the market declines, you will have the funds available for distribution with no worries about having enough income. You set the time periods for each portfolio based on sources of income not dependent of market conditions, in this instance you would have three years’ worth of income that’s not affected by market conditions. A second “bucket” with enough money for another four years or more of income. These portfolio funds would be invested in a mix of longer-term bonds and stocks for growth. That way the money has the potential to grow, but with less risk of significant losses during market downturns. A third “bucket” is for portfolio funds not expected for distribution for seven years or more. These funds can be invested more aggressively based on your risk tolerance and this investment time horizon. This approach to developing various portfolio “buckets” reduces the risk of spend down and provides for more productive use of portfolio funds.

Due to the different expected rates of returns for each portfolio “bucket”, the moderate bucket is expected to fill faster than the conservative one, and the aggressive one is expected to fill faster than the moderate. This results in funds that cascade to refill the other buckets with the earnings so that you’ll have stable funds from which to draw your income. True North Financial Advisors work closely with investors on the timing of the movement of funds between portfolio “buckets” to mitigate the risks of portfolio spend down to avoid the risks of forced liquidation of portfolio investments when the market’s performance is down.

Rules-Based Investing – Investment Selection Process

The establishment of a asset allocation models for your portfolios is the first step to managing Sequence of Returns Portfolio Risk. Next, a securities selection process that relies upon a Rules-Based Investing approach is governed by the establishment of rules for the investment selection process. These investment rules guide overall portfolio asset allocations, between equity and fixed-income, security selection and buy/sell/hold decisions for a client’s portfolio. The rules-based investment process is designed to remove emotion and personal bias, resulting a disciplined approach for the entire portfolio management process. Rules-Based Investing is a decision-making process designed to align investors’ financial objectives with an individually constructed investment portfolio.

Important Disclosures

True North Financial Advisors provides “rules-based” investment strategies in commission-based and fee-based discretionary investment accounts, designed to protect profits and limit losses. All investment strategies involve risk and may result in the loss of principal. Investors are encouraged to contact True North Financial Advisors for more details.

For help protecting your retirement nest egg and generating the income you need in retirement, contact the investment professionals at True North Financial Advisors by calling 855-377-7526, to Set Your Own Course.